gst on commercial property malaysia

Meanwhile other building materials fall inside Second Schedule Goods in which all the goods in this category will only be charged sales tax of 5. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

Sst Will Property Prices Come Down Edgeprop My

Sales tax and service tax will be abolished.

. However recent guidance released by the authorities could bring private individuals who would not consider that they are in business into the mix. Whether buying selling or leasing you will be classified as an enterprise and. Stamp Duty The stamp duty increases progressively as follows.

To illustrate a simple analogy would be as follows-. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. This can happen when a there is a purchase of commercial land or a completed commercial building and the.

This means that the commercial property buyers or investors will pay GST to the. A 6 GST is applicable when you buy a commercial property from the seller who is GST-registered. In real estate the beneficial owner of the property has the responsibility to collect GST and remit it to the Canada Revenue Agency CRA.

In some cases businesses are also entitled to a GST Refund from Customs. With regards to GST treatment on property developer. Criteria of commercial property owners who have to be GST-registed.

Yong of TAMS concludes there is no point. On April 1 he has paid only RM400000 because it is 40 complete. Commercial property is defined in the A New Tax System Goods and Services Tax Act 1999 GST Act.

If the property is held in trust by another corporation. However developers will pay GST on some of their production inputs. In the GST era tenants needed to pay 6 of the rental value of a commercial property to the property owner if the propertys annual rental exceeds RM500000.

Under GST the sale of commercial. The remaining 60 will be subject to GST because it is a commercial property. Sale of residential property is GST exempt.

GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. Under the new GST. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

Overview of Goods and Services Tax GST 2. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The GST registered seller is allowed to charge GST on the sale lease and rental of commercial properties.

For upcoming commercial and industrial properties purchased before completion buyers are subject to an additional 60 percent GST. Below Ive listed the taxes you normally need to pay when investing in Malaysia commercial property. As the propertys price is billed based on.

In most cases yes you will be required to pay GST on a commercial property purchase. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input. While there may be some similar features between commercial and residential.

Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is. Sale of commercial properties will be subject to 6. Any tenancy lease easement license to occupy of a commercial property is a supply of services therefore GST applies.

Tips Tricks To Commercial Property Investment In Malaysia

Sst Will Property Prices Come Down The Edge Markets

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

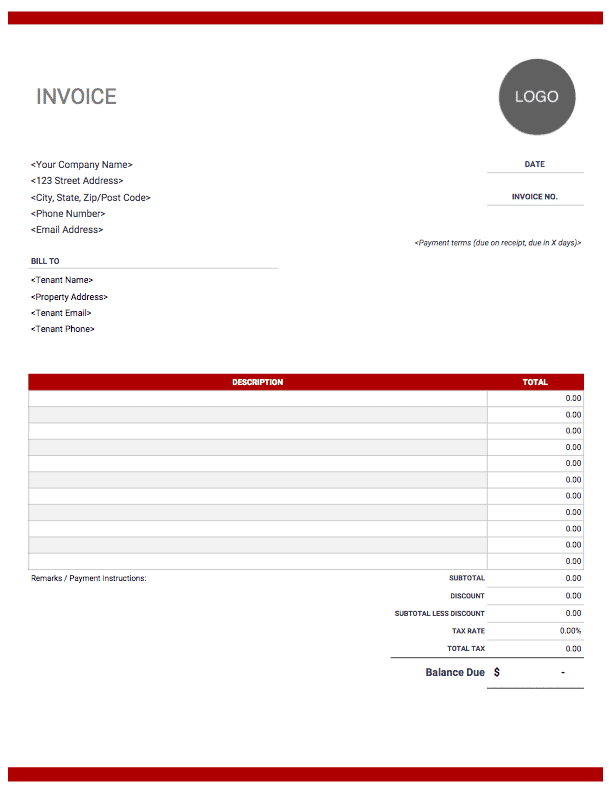

Rental Invoice Templates Free Download Invoice Simple

All Malaysians Should Be Aware Of These Property Taxes Wma Property

What Is The Difference Between Commercial And Residential Real Estate Goel Ganga Developments

Gst On Commercial Property Complete Guide Realcommercial Com Au

Residential Vs Non Residential Land

Taxes Applicable On A Commercial Property You Need To Know About

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

Tips Tricks To Commercial Property Investment In Malaysia

3 Addressing The Vat Gst Implications Of The Sharing Gig Economy Growth A Range Of Tax Policy And Administration Options The Role Of Digital Platforms The Impact Of The Growth Of The

5 Tax Considerations When Selling Off Your Property Iproperty Com My

Indirect Tax Kpmg United States

Buying Commercial Property In Malaysia A Complete Guide

How Gst Will Impact Home Prices The Property Market

Tax Navigating The Tax Minefield Of Property Investments Wealth Mastery Academy

Budget 2022 Malaysia Needs Gst To Weather Turbulence Ahead Say Experts Edgeprop My

Comments

Post a Comment